India’s Push for Locally-Made Telecom Equipment, Impacting Foreign Gears

India’s telcos are being told to ditch the imports and go desi - a move that could shake up the entire telecom game. But swapping global gear for homegrown isn’t just about who makes the equipment, it’s about how fast it actually hits rooftops and towers. And that’s where TowerBuddy comes in - making sure new networks don’t just look good on paper, but go live on the ground.

Why This Matters

India’s telecom equipment market size reached USD 24.46 Billion in 2024, expected to reach USD 34.74 Billion , CAGR of 3.97% during 2025-2033. These figures underscore why sourcing policy matters for operators and vendors.

A shift to local procurement would affect global gear suppliers like Nokia, Ericsson, Cisco, Samsung and lift domestic OEMs like Tejas Networks, HFCL, Sterlite/ STL, VVDN and system integrators such as TCS / C-DoT.

The move aligns with India’s broader push for self-reliance, especially amid rising global. trade tensions and higher tariffs.

What the DoT asked for and when

The Department of Telecommunications (DoT) has asked operators to submit roadmaps for adopting local gear, the news report said.

- If companies do not comply voluntarily, the DoT could set binding timelines for implementation.

- A DoT standing committee earlier rejected a telecom regulator proposal to give licence fee rebates for using indigenous gear. That plan is now being re-examined.

- Telcos have agreed in principle, but want locally made products to match foreign gear on price and quality.

- The government is considering applying the rule only to new orders, avoiding costly replacement of existing equipment, the news report said.

Who Wins & Who Loses

Potential Losers: Global telecom vendors who currently supply a large share of India’s active network kit. Reduced share on new orders would dent future sales pipeline in a big market.

Potential Winners: Indian OEMs and system integrators — Tejas, HFCL, Sterlite (STL), VVDN and the likes — which have been increasingly active in recent government-led projects and BSNL’s rollouts. BSNL’s 4G/5G programme, where Tejas, C-DoT and TCS are major players, is already a testbed for “local first” procurement.

Supply Chain & Quality Concerns - Why Operators are Cautious

While operators have expressed willingness to shift to local gear, they remain cautious. Their primary concerns are:

- Price parity: Domestic equipment must remain competitive with global alternatives.

- Performance and reliability: Networks cannot compromise on service quality.

- Scale: Local vendors are expanding but still face challenges around component sourcing, testing, and interoperability when rolled out nationwide.

BSNL’s case shows that while local sourcing is a milestone, scaling it across a national network is still challenging.

What This Means For Rollouts (BSNL + private 5G plans)

BSNL has been the government’s domestic-gear showcase: large orders and partnerships (TCS, Tejas, C-DoT) to build 4G now and move to 5G after stabilization. Recent procurement orders and announcements show significant local sourcing activity tied to BSNL’s rollout.

Private 5G deployments: Operators have expressed concerns that direct allocation or strict procurement rules for private networks may raise costs for enterprises. Industry proposals suggest provisioning CNPNs via licensed operators using network slicing instead of enterprises managing full network stacks.

Also read: How Smart Telecom Towers Are Powering 5G, IoT, Edge Computing & more - for Landlords, Towercos & MNOs Alike

India already hosts hundreds of thousands of towers, and BSNL alone accounts for a large fleet as it upgrades to 4G/5G. These site numbers matter: even if procurement shifts to local OEMs, someone still needs to find, ready and equip sites at scale.

The Operational Gap

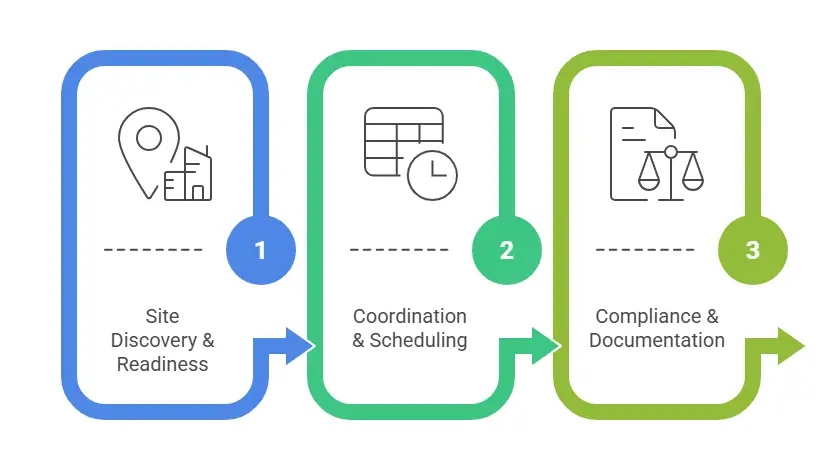

Getting more local gear into networks isn’t only a manufacturing or procurement issue - it’s an operations and logistics challenge. Local equipment availability must be matched by a frictionless, operator-ready rollout process. The main operational gaps are:

- Site Discovery and Readiness: New deployments (and new-order installs) need rooftops and tower sites with clear permissions, landlord agreements, structural checks, reliable power, backhaul readiness and local civil works.

- Coordination and Scheduling: Operators, domestic OEMs and system integrators need a single source of truth for site specs, documentation and availability to synchronise installations. Poor visibility increases lead times and cost.

- Compliance and Documentation: Local procurement is often accompanied by tighter compliance and audit requirements - certified site documentation and standardised verification reduce friction.

Also read: How do I list my property on TowerBuddy?

TowerBuddy solves these operational gaps. We maintain operator-grade site inventories with verified documentation and landlord consent records - so when operators and domestic OEMs place new orders, they can map equipment to deployment-ready sites immediately. The result: Faster time-to-deploy for locally sourced gear, lower soft costs (permits, scheduling delays), and improved predictability for pilots and scale rollouts. By acting as the operational bridge between procurement and field activation, TowerBuddy helps convert policy targets into live networks without adding deployment friction.

Conclusion

India’s push to prioritize domestic telecom equipment starting with new orders and guided by DoT roadmaps is a strategic move that could shift market share in the world’s second-largest telecom market. The policy focuses on new orders rather than immediate replacement, balancing industrial strategy with cost considerations. Successful implementation will depend on manufacturing scale, financing, and efficient deployment processes. Verified site inventories, standardized documentation, landlord approvals, and scheduling are critical to turning procurement targets into operational networks. A strong deployment ecosystem is essential to ensure domestic gear succeeds on price, quality, and speed.